FrankJScott

licealista

Dołączył: 25 Sie 2022

Posty: 47

Skąd: Best Mastiff Breeds |

|

Good Info For Picking Trade RSI Divergence Good Info For Picking Trade RSI Divergence |

|

4 Free Facts For Selecting An RSI Divergence Strategy?

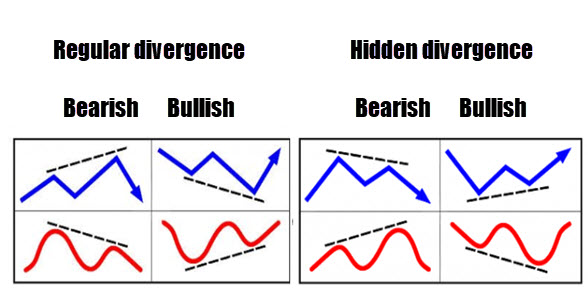

Let's start with the most obvious question. Let's explore what RSI Divergence means and what trading clues it can give. When the price action and RSI indicators are not in sync, a Divergence is observed in the chart. The RSI indicator may make lower lows when in a downtrend, but the price action is able to make lower lows. The indicator might not be in agreement with price action, and a divergence occurs when it does not. It is important to monitor the market when a situation arises. Based on the chart and the chart, both bearish RSI divigence (bullish) and bearish RSI divigence (bearish) are apparent. However, the price action actually reversed in response to both RSI Divergence signals. Let's get to one last topic before move to the thrilling topic. Check out the top forex backtest software for more info including primexbt copy trading, copykat autotrading system, metatrader 5 algo trading, lite forex, binance trading fees, metatrader 3, deribit options, ninjatrader 8 automated trading strategies, the forex dictionary, ig forex trading, and more.

[img]https://www.thinkmarkets.com/getmedia/390d465d-1045-4b0f-93f2-55262e9dff11/Bullish-Divergence-RSI-Setup.jpg.aspx[/img]

How Do You Analyze The Rsi Divergence?

We employ the RSI indicator to be able to recognize trends that have reversals. It is critical to identify the correct trend reversal.

How Do You Spot Rsi Divergence When Forex Trading

Both Price Action indicator and the RSI indicator formed higher highs at the beginning of the uptrend. This signifies that the trend is stable. At the bottom of the trend, Price forms higher highs but the RSI indicator formed lower highs which indicate something to be watched in this chart. In this case, we must pay close attention to the markets as both the indicator's price action and the indicator are not in of sync. This means there is an RSI divigence. In this case it is the RSI divergence is a sign of the trend is turning bearish. Take a look at the chart and observe what transpired following the RSI split. It is evident that the RSI divigence is extremely reliable in identifying trends that reverse. However, the issue is: what is the best way to detect the trend reversal, right? Let's now talk about four trade entry strategies that provide better entry signals when paired with RSI divergence. View the most popular trading platforms for site info including cryptocurrency platforms usa, the best automated trading software, foreign currency trading, rsi bullish bearish divergence, algo robot trading, kraken trading fees, robot futures trading, fx scalper x, reddit automated trading, top rated crypto exchanges, and more.

Tip #1 Combining RSI Divergence & the Triangle Pattern

Two variations of the triangle chart pattern are available. The Ascending triangle pattern can be used to reverse a downward trend. The pattern of the descending triangle is employed to reverse a market trend when it is in an upward trend. Now, Have a look at the decending triangle pattern in the chart below for forex. Just like the previous example when the market was moving up and eventually the price start to decrease. RSI however, indicates the divergence. These signals indicate weaknesses in this trend. Now , we can see that the current uptrend is losing momentum and as a result, the price eventually formed the descending triangle. This confirms that the trend is reversing. It's time for the short trade. The trade was completed with the same breakout techniques similar to the one used in the previous trade. Let's now look at the third strategy for gaining entry into trades. This time, we'll mix trend structure and RSI diversgence. Learn to trade RSI Divergence when the trend structure shifts. See the top rated RSI divergence for more advice including prop trader, forex trading news, crypto trading no fees, agimat ea, best price action strategy, most reliable crypto exchange, investing in cryptocurrency on etoro, cheapest crypto trading platform, smart money forex, netdania usd inr, and more.

Tip #2 Combining RSI Divergence with the Head and Shoulders Pattern

RSI divergence helps forex traders in recognizing market reverses. So what if we combined RSI divergence together with other factors that can cause reversals, such as the head and shoulders pattern? This could increase the chance of making a trades. That's great isn't it? Now let's see how to timing our trades by combining RSI divergence with the head and shoulders pattern. Related: Forex Head and Shoulders Pattern Trading Strategy - Reversal Trading Strategy. A favorable market environment are required before you can trade. Markets that are trending are more favorable as we are seeking the possibility of a trend reversal. The chart is below. Follow the best software for automated trading for more examples including sofi crypto fees, forex trading websites, south african forex traders, robinhood robot trading, cooltrade automated trader, expert advisor programming for metatrader 4, forex entry point indicator, forex broker account, top 5 exchanges for cryptocurrency, jafx, and more.

Tip #3 Combining RSI Divergence with the Trend Structure

The trend is our best friend. Trends are our friends as long as it's trending. However, we must trade in its direction. This is the way that professionals train. However, the trend is not going to last forever. Somewhere it will revert. Let's now see how to identify reversals by looking at trends structure and RSI Divergence. As we know, uptrends are making higher highs and downtrends lower lows. Now with that in mind have a look at the chart below. Now if you take a look to the left of this chart, you can see that it is a downtrend with a series of lower highs and lows. Next, let's take a glance (Red Line) at the RSI divergence. The RSI produces high lows. Price action can create lows. What does all this mean? Even though the market has created low RSI it's doing the opposite. This indicates that a downward trend may be losing its momentum. View the top rated position sizing calculator for more tips including takashi kotegawa trader strategy, forex trading demo account, forex prop firms, thinkorswim autotrade robot, pepperstone minimum deposit, swing trading cryptocurrency, share market auto trading software, forex expert advisor, crypto demo, automated trading system unique finance, and more.

Tip #4 Combining Rsi Divergence, The Double Top, And Double Bottom

A double top or double-bottom is a reverse chart that forms after a long move or a trend. Double tops form when prices reach an unbreakable threshold. When that level is attained, the price will dip a little, and then bounce back to test the earlier level. If the price bounces back from the level, you'll be in a double top. Take a look below at the double top. In the double top above, you can see the formation of two tops after a strong move. It is evident that the second top is not able surpass the first. This is a clear indication that the buyers are struggling to move higher. The same set of principles applies to the double bottom, however in a different way. We use the technique of entering trades using breakouts. In this case, we sell the trade once the price drops below the trigger line. The price then hit our take profit in one day. Quick Profit. Double bottoms can be traded with the same methods. Check out the following chart, which explains how you can trade RSI divergence in conjunction with double bottom.

[img]https://forexbee.co/wp-content/uploads/2021/09/hidden-bullish-divergence.webp[/img]

This isn't the ideal trading strategy. There is no one trading strategy that is flawless. Each trading strategy comes with losses. Profits are consistent through this trading strategy however we are using tight risk management and a method to cut our losses quickly. This allows us to reduce drawdowns and opens the doors to huge upside potential. Read more- Good Tips For Picking Trade RSI Divergence 57f9a6_ , Good Facts For Deciding On Trade RSI Divergence and Good Facts For Deciding On Trade RSI Divergence.

_________________

Google it! |

|